Westaim (WED.V) - Transitioning From Sum of Parts HoldCo to OpCo Compounder

My first Twitter post on Westaim was on June 5 2024, when I stumbled upon them while screening for insurers/banks trading at less than book. At the time they were trading at 0.72x book value with no debt, and the majority of their assets were level 1 securities and cash. After listening to their 2024 Annual General Meeting I was pretty impressed with the team and realized that Westaim’s ownership in Arena Investors was worth much more than book value. Today, the business has rerated to book value following the CC Capital transaction announcement (much more on that below), and that’s where this story gets pretty interesting. TLDR - I think this is a pretty attractive and asymmetric opportunity for the following reasons:

Westaim is trading at ~1.1x book value, meaning the market has very low expectations for the new business. Makes it harder to lose money.

Westaim is entitled to 49% of Arena’s profits, an asset manager with a clear path to $10B AUM by 2027/2028, and is on the balance sheet for $23M. This is a “hidden asset” which I believe could be worth $500M - $1B by 2028.

Additional upside if Ceres Life is able to generate ROEs of 15% - 20% like management has guided to, implying that Ceres Life should trade at a multiple >1x book.

I believe that the management team is a group of skilled capital allocators and talented operators with aligned incentives. This idea requires trust in management’s ability to execute, and I believe they have demonstrated their ability to do so.

Westaim History

I get it - Westaim’s stock chart looks really scary - down 97% all time is pretty gnarly. However, everything before 2009 is essentially irrelevant. Westaim spun-off from Viridian in 1996 where it operated a handful of businesses where they created biomedical coatings, ceramics, and electroluminescent flat panel displays, among other things. As you can imagine this collection of businesses wasn’t the greatest and Westaim’s board led a strategic review which resulted in all of the businesses being divested between 2005 and 2008. In 2009, the current management team was put into place, and this is where our Westaim story begins.

Since 2009, Westaim has operated as a financial holding company, opportunistically investing in financial services businesses. The case studies of Westaim’s previous investments can be found on their website here, but I’ll give a brief overview. Westaim’s first investment in 2010 was a $260M CAD investment in Jevco, a Canadian automobile insurer. Westaim was not involved in the day-to-day operations, but worked on capital allocation and long-term growth and strategic plans. Two and a half years later, Westaim sold Jevco for $530M CAD, representing an approximately 29% unlevered IRR.

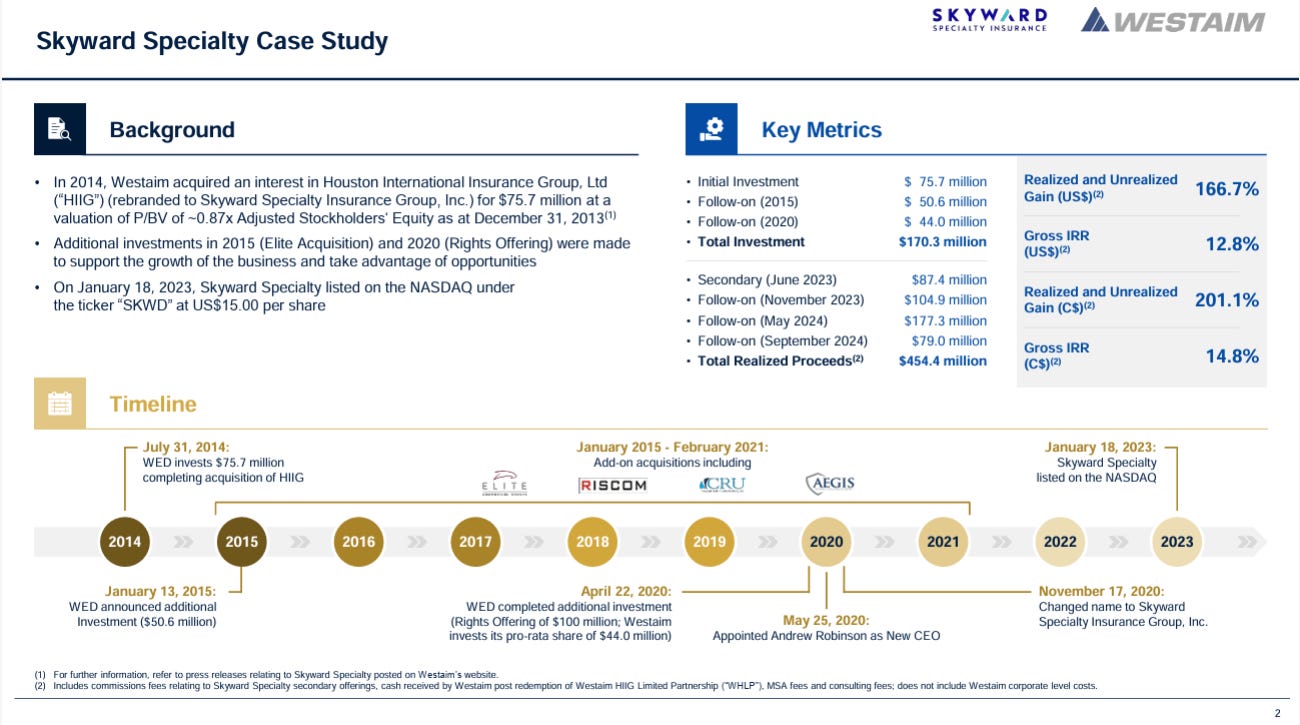

Westaim’s next investment in 2014 was in Skyward Specialty (then Houston International Insurance Group), a specialty P&C insurer. Westaim made several follow-on investments for a cumulative investment of $170M. Skyward ultimately IPO’d in January of 2023 and is now up ~180% since its IPO. Westaim generated ~$450M in proceeds, resulting in a ~12.8% gross unlevered IRR. Westaim has now fully exited its SKWD position.

If you were to have invested in WED.V in the beginning of 2009, you would’ve generated total stockholder returns of ~950%, a ~15.8% IRR.

Westaim - Pre CC Capital Transaction

Prior to the CC Capital transaction on October 10th, Westaim consisted of 3 separate assets that were driving value:

Equity stake in Skyward Insurance (now monetized)

Ownership of Arena Asset Management - a unique private credit fund with >$3B AUM.

~$170M of “ARENA FINCOs” which are private equity/credit investments made by Arena that Westaim holds on their balance sheet.

The Skyward stake has now been liquidated into cash and management has announced their intention to liquidate the FINCOs. Because of the holdco structure, Westaim has rarely traded at more than book value, despite Arena being listed on the balance sheet for only $23m.

The balance sheet below is before the impact of the CC Capital transaction:

Westaim - Post CC Capital Transaction

On October 10th, 2024, Westaim announced a transaction with CC Capital to create an integrated insurance and asset management platform. CC Capital has committed $250M to the transaction, leaving Westaim ~$600M of capital to be invested into the new platform (excluding FINCOs), and $100M for share buybacks. On a fully diluted basis assuming warrant conversion, common shareholders own 59% of the new co.

With $743M USD of net assets, pro-forma for the transaction, this leaves common shareholders with ~$438M of tangible book value. As of March 27, with a share price of 31.80 CAD, Westaim is trading at ~$480M USD. 1.1x P/TBV pro-forma the transaction. At 1.1x P/B, the market is giving Westaim no credit for their ability to generate ROEs of greater than 10% moving forward. Additionally, keep in mind that Westaim’s investment in Arena, which they now have 100% ownership of (but 49% of earnings after profit share with management and CC Capital), is only being valued at $~23M. If Westaim was to generate 10% ROE into perpetuity, I would say P/B of 1x is fair. But I think they can generate much more than that. Management does too (see below).

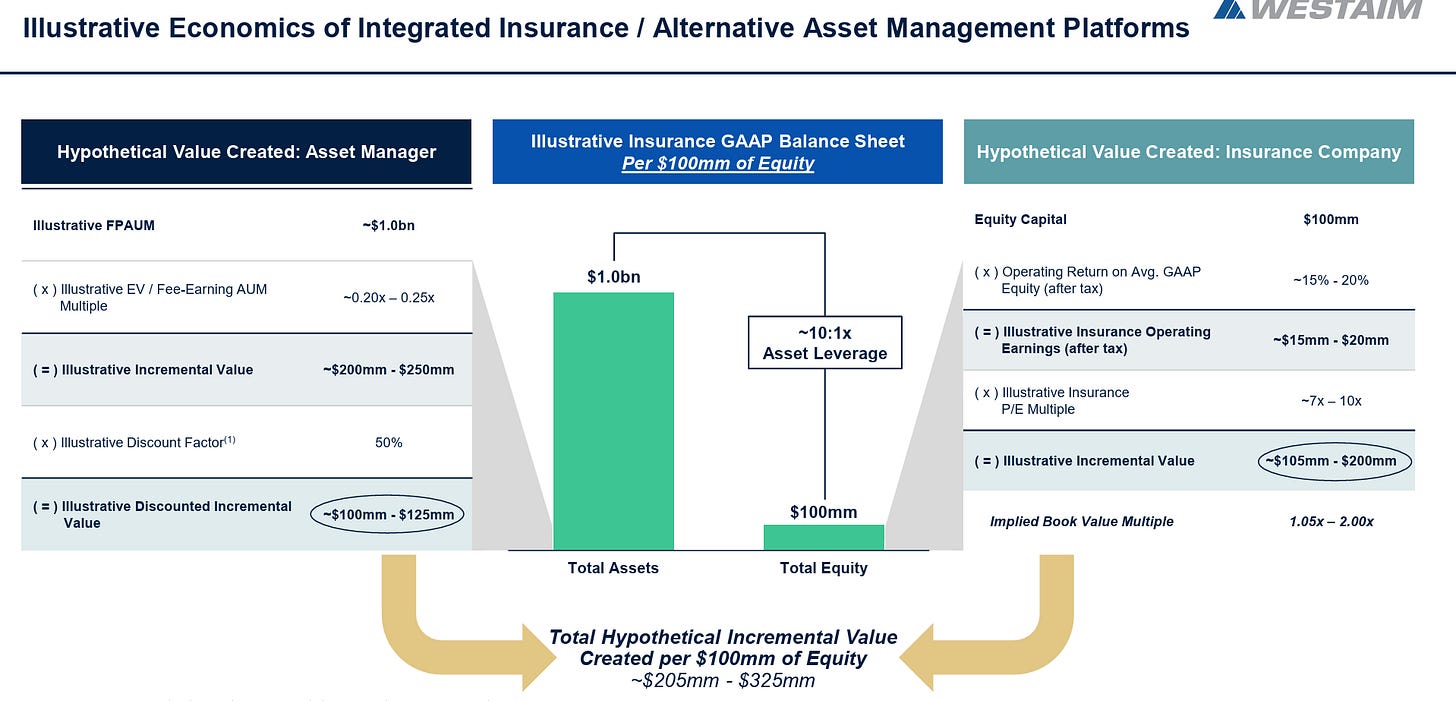

Westaim will use the cash to capitalize Ceres Life, a de novo annuities business, and invest up to 90% of the capital with Arena. So they will make money in a couple different ways:

Margin on the annuities business = how much they earn on their investments - how much they pay out to annuity holders.

Arena management + incentive fees from assets managed on behalf of Ceres Life. (up to 90% of Ceres Life’s assets)

Arena management + incentive fees on assets managed for other entities. As of Q1 2025, Arena had $4.2B of AUM and programmatic capital. None of this is from Ceres Life.

I’ll talk first about Arena given its already on their balance sheet, and then jump in to Ceres Life, how they’ll work together, and how I’m thinking about valuation.

Arena Investors

Arena Investors is headed by CEO/CIO Dan Zwirn, who founded Arena in 2009 after working for various private credit and special situations firms for ~15 years. Westaim joined Arena’s journey in 2015 with a $146M USD investment to help support Arena’s growth. (remember, this is $22M on the balance sheet right now) Arena offers investors a few different products; multi-strategy, excess capacity, and stable income. Multi-strategy is their core diversified product. Excess capacity is when Arena identifies a particular asset class/geography that is abnormally attractive but doesn’t want to overwhelm its multi-strat fund, so it uses excess capacity vehicles instead. One example is Arena’s investments in New Zealand government subsidized housing. Stable income is a lower absolute return product that’s full of investment grade products and is popular with insurers. Since inception, Arena has generated an 18.6% gross IRR on exited investments.

Arena has a pretty interesting structure which operates through 50+ joint ventures across the world. Each joint venture partner is “focusing on very specific micro specialties across the world”. These joint ventures allow Arena to benefit from the broad scope and large opportunity set of a generalist investor, but also the nuanced understanding of niche investment opportunities through its JV partners. Below is a quote from Dan Zwirn on how the JV structure allows them to find the best opportunities across the world.

“So when we are shunning everything in the everything bubble, it’s not because I’ve had kind of a grand top down view of things, it’s because we’re dispassionately looking at the returns per unit of risk across the world across products, and we can see it, it’s obvious. If I’m in India and someone wants to borrow 17% Indian Rupee in a tough situation, and I can do that same return in USD 3 blocks from our office in Midtown, well I shouldn’t do the former, should I?”

Additionally, this allows Arena to make a lot of investments but at a smaller check, with the average check size being between $5 - $50M. This enables Arena to look at investments that most of the mega funds just can’t make.

Since Westaim’s investment in 2015, Arena has grown its AUM and Programmatic Capital from $200M to $4.2B in Q1 2025. This includes an $800M increase in Q1 2025, although we’ve gotten very little information as to what drove the increase (it’s not Ceres Life capital).

Another interesting aspect of Arena is its Quaestor Advisors (QA) business. Quaestor Advisors services the loans on behalf of Arena and also reviews all investments before they are made. As a result, QA takes a servicing fee of about 50 - 150 bps points. This improves the operating leverage of Arena; rather than using 3rd party loan services for each loan they make, they can use QA and generate additional servicing fees with low incremental investment. Additionally, under what Arena is calling “Arena Investor Services”, Arena offers similar servicing and consulting services to 3rd party investors. This allows Arena to use their existing infrastructure which they use for their own business, and generate extra revenue via 3rd party customers at low marginal cost. Once again, this adds more operating leverage to the business which should prove accretive as Arena continues to ramp up AUM.

I’ll talk more about Ceres Life below, but I wanted to mention it here to explain its impact on Arena. Given the amount of operating leverage embedded in this business, and most asset management businesses for that matter, incremental increases in AUM should prove highly accretive to Arena. Following the CC Capital transaction, Westaim will have $600M to capitalize Ceres Life, the annuities business. Assuming a 10x leverage ratio, which is common for the industry and is the number management gave, Ceres Life will have $6B of capital that it needs invested. Assuming 90% of the capital is invested with Arena, this will result in $5.4B of incremental AUM, more than doubling Arena’s AUM and bringing them close to $10B. So with only capital that Westaim has today, Arena is on path for $10B of AUM in just a couple of years. Additionally, once this business gets going and Arena + Ceres Life are growing retained earnings, that will be additional capital that can be levered 10x and added to Arena’s AUM.

Another piece that deserves some discussion is the lack of growth in Arena AUM over the past couple years. From 2022 - 2024, the AUM and Programmatic Capital of the business remained essentially flat. This has resulted in stagnating/declining management fees and has hurt profitability. During the 2024 AGM, many questions were asked regarding the stagnating AUM growth. Dan answered in the following way:

"Under $5B, we’re still emerging. There have never been higher barriers to doing this. Now that we’re in our 3rd fund, we’re occasionally viewed as grown ups when we come to the table. But the bias towards big roman numerals and big AUMs and career protection is enormous. So you just have to be relentlessly focused on kind of grinding past that.”

I think this more or less makes sense, particularly when you couple it with the fundraising environment being tougher in the past few years. Private credit fundraising has been slowing (albeit still at high levels on an absolute basis) and fundraising has also been consolidating to the largest players (Apollo, Blackstone, Ares, Oaktree, etc.).

It is nice to see that in Q1 Arena had a $780M jump in Programmatic Capital and on March 27, 2025, an article came out saying that IFC was looking at investing $100M in an Arena special purpose vehicle in Asia. So it seems like they’ve got some momentum going recently. Ultimately though, there are two big reasons why I’m not overly worried about the slowdown in AUM growth. First, Arena has $6B of assets coming its way from Ceres Life that it will be deploying in the next couples years which takes the pressure off of AUM growth from other allocators. Additional capital from there just offers some more upside optionality. Second, Arena’s returns speak for themselves, and in the long run, that will be the ultimate driver of AUM. Arena has generated an 18.6% gross IRR on realized investments since inception, and had 100% of investors from Fund 1 return to Fund 2. Currently, they have 136 active positions with a current IRR of 11.5% and an underwritten IRR of 18.0%. Dan explains that delta at the 2024 AGM in the context of some of the distressed/restructuring lending they do:

“And until you do an RTO and get it listed again or you sell the asset or whatever, you're not going to get that. And so what you've seen is historically, there was up to a 700 basis point delta between our lifetime exited investments, which are now at a 20% unlevered yield and are active because you continue to see these kind of Vs, right, which is just necessarily what happens when you do this.”

Ultimately, even if Arena AUM ceases to grow outside of Ceres Life assets, we will still see management fees of ~$100M by 2028, compared to ~$30M in 2024.

Key assumptions of the above model include:

$600M of equity is levered 10x at Ceres Life to write $6B in annuities. The $6B is deployed and written over a 3 year period, with AUM from Ceres Life hitting $6B by end of year 2027.

10% annual AUM growth ex. Ceres Life.

Operating expenses grow 15% in 2025 and then 4% from there on out.

Mgmt fees of 80bps, asset servicing fees of 30 bps, and net incentive fees at 30 bps of AUM as well. These are based on historical fee rates.

Ceres Life

Ceres Life is the liabilities side of the new platform being built, and will be writing annuities for policyholders. The annuities business is a spread-based business; net investment income less benefits paid to policyholders. The key questions for the business are:

How much leverage are you using?

What is the cost of benefits, i.e., the interest you’re paying to policyholders?

What is your investment yield, i.e., the return you’re earning on your investments (largely with Arena for Ceres Life)?

How much overhead do you have and what is the resulting expense ratio?

All of these questions come together to determine what return on equity (ROE) the business will earn. See example below:

The closest comp we have for Ceres Life is F&G Annuities, which was purchased by CC Capital in 2017 and sold to FNF in 2020. Not only are they a close comp strictly from a business perspective (close to pure play annuities), but also because both were run by CC Capital at some point. When CC Capital acquired F&G, they installed a new management team and created a partnership with Blackstone to increase investment yields. In 2024, F&G generated ~12% ROEs, 1.27% ROAs, and is trading at ~1.7x P/TBV ex. AOCI. See ROA bridge below.

I think the economics of Ceres Life could end up proving to be fairly similar to F&G, but I think there are a couple reasons why they could be higher. First, Ceres life has no legacy liabilities, its a brand new book, so they can shape the portfolio however they want. Management has indicated that they’re looking to write fixed indexed annuities (FIA) and Multi-Year Guaranteed Annuities (MYGA). These are two different types of deferred annuities where the interest accrues instead of being paid out in cash. A typical FIA has an “accumulation phase” from 5-10 years where annuity payments are accrued, and when the accumulation phase is over, the policyholder can choose to surrender the annuity and take the cash as a lump sum, or to annuitize the cash into a cash flow stream. During the accumulation phase, the annuities are “surrender protected”, meaning that policyholders would have to pay a ~10% fee to withdraw early. As you can see, these are long duration liabilities that don’t require any cash payment for a long period of time. This will likely allow Ceres Life to invest in longer duration assets and allow them to take on a bit more risk, resulting in higher investment yields. However, on the cost of funds side, I don’t see their being any significant deviation given the commoditized nature of annuities.

Another way Ceres Life could generate higher ROAs/ROEs is through a leaner cost structure. The CEO of Ceres Life will be Deanna Mulligan, former CEO of Guardian Life, a mutually owned life insurer with $80B+ of assets. She was the CEO for 10 years, and since then has been working on building a digital annuities platform, now Ceres Life. Not only does Ceres Life have no legacy liabilities, but they also have no legacy infrastructure. Here are a few of the comments from management

“Significant improvement in operating margins over legacy operations due to the automation capabilities of an end to end cloud native solution.”

“No legacy infrastructure enables team to thoughtfully architect an industry leading operating platform anticipated to drive meaningful efficiencies at scale.”

Intuitively, this makes sense. I don’t think we have enough information to really know what kind of margin uplift Ceres Life will have over F&G, but given the de novo nature of the business and management’s comments, I see room to the upside on the margin profile.

One of the big questions remaining is how quickly can Ceres Life ramp up the business? The longer it takes for them to write policies and put the $600M of capital to work, the longer they’ll burn cash, and the longer the cash will be losing to opportunity cost.

Management has a couple solutions that should shorten the window in which Ceres Life is burning cash. First, Westaim already made the acquisition of ManhattanLife of America who already holds insurance licenses in 46 states and DC, so no need to wait for regulatory approval. They’ve also announced that they will be working with Advisors Excel, an Independent Marketing Organization(IMO), which will help drive growth from day 1. Management said, “Advisors Excel has been integrally involved in the creation of Ceres Life platform… partnership with IMOs, especially those supporting our distribution channels will be a clear competitive advantage.” Additionally, Ceres Life CEO Deanna said, “This is a first of its kind partnership for a de novo annuities carrier… we expect this relationship will significantly support Ceres Life’s growth trajectory, helping us deliver more assets to Arena and in turn, scaling Ceres Life.”

In addition to having IMO partnerships in place, Westaim has also talked about block and reinsurance opportunities. If Ceres Life is not able to scale organically quick enough, they can pursue block transactions where they simply purchase large blocks of annuities from capital constrained mutuals. This will allow Ceres Life to deploy equity very quickly, assuming they can pursue these transactions at an attractive price.

In response to a question about liquidating the ARENA Finco’s, Chinh Chu (CEO of CC Capital) said the following, “The good news is that with the existing cash on the balance sheet, plus up to $150 million of capital, there is not an urgent need to do that, although we want to do it expeditiously, we have more than ample capital for the next few years.” Although not an exact science, I generally take “few” to be 3, so I’m underwriting that the $600M is gradually deployed over 3 years end fully deployed by the end of 2027. From that point, retained earnings will keep the flywheel going, allowing Westaim to compound.

I had to take an absurd amount of liberties making assumptions for this model given the company doesn’t exist yet, but here’s a snippet of key assumptions and the income statement:

And a simplified balance sheet:

ROEs for this model are below managements “guide” of 15-20%, so keep in mind I’ve already baked in some conservatism. With net income ~$100M by 2028 and an 10x multiple, you get $1B valuation for Ceres Life (13.5% ROE).

Putting It All Together

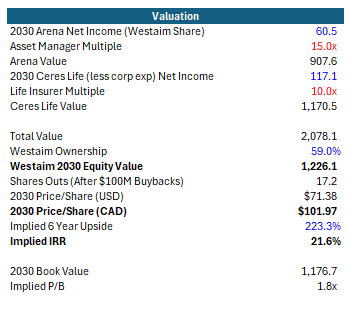

So how much is Westaim worth? Some key assumption in the model below:

Arena trades at 15x earnings and Ceres Life trades at 10x earnings.

Westaim runs $20M in corporate overhead in 2025, growing with inflation.

Westaim repurchases $100M of shares at $31.54 CAD / share.

~13% ROE for Ceres Life and ~4% ROE uplift from Westaim’s share of Arena profits net corporate overhead.

Using a 10x and 15x multiple for Ceres Life and Arena, respectively, brought us to an implied P/B of 1.8x. With ROEs of >17%+, I think that seems pretty fair. And, as I’ve mentioned, I think a future exists where the ROEs of the business are higher than what I’ve modeled. I’m welcome to any and all pushback on these numbers, so please let me know if you don’t agree with something.

Risks

Execution risk: Ramping up from $0 of annuities written to billions written is not an easy task. Does all of the tech infrastructure work? Are all of the key hires in place? How quickly can Ceres Life reach $6B annuities in force?

I think this risk expresses itself in the model by simply taking longer to write annuities. Rather than reaching $6B by end of year 2027, maybe it takes until ‘28/’29/’30. This would result in lower ROEs for a longer period of time before the business scales.

Lack of scale / higher cost structure: There is a risk that Ceres Life has more overhead than I’ve modeled, resulting in a higher cash burn in 2025/2026. There’s not much to mitigate this one besides from ramping up quicker. It’s more just a lack of information risk.

Expressed in the model with higher op exp in ‘25/’26 and more cash burn.

Arena blows up: There’s always a chance that Arena makes bad investments that could blow up leading to bad investment yields for Ceres Life, but also a decline in AUM from other LPs. I think this one is mitigated by a) history of high realized returns and b) high quality management and aligned incentives. Arena’s management has a ~40% profit share agreement on Arenas’s earnings, making them highly incentivized to not do anything stupid. Also, if you’re worried about Arena and private credit in general, you should listen to Dan speak at the 2024 AGM. He’s honestly a perma-bear which is exactly what I want from a private credit manager.

Another Arena risk which I think is very real is that they struggle to attract AUM outside of Ceres Life. I’m currently underwriting 10% ex Ceres Life AUM growth, so anything less would be a downward revision on my model. However, it seems Arena has had some momentum attracting outside AUM recently, and as Arena increases its AUM from Ceres Life, they will likely gain some legitimacy sitting at the table with LPs having $10B AUM instead of $3B. Also, more insurance companies could come to Arena looking to outsource their investing given 50% of their LP basis is currently insurers.

Catalysts

Management has announced their intention to buyback $100M of shares and just announced an NCIB for 10% of outstanding shares. They’ll be hitting the bid quite a bit.

2025 Annual General Meeting will occur on June 12, 2025. I imagine management will have a lot more details to give on the new business. The clearer the future becomes, the more confidence investors will gain.

Westaim currently trades on the TSX Venture Exchange, a smaller exchange meant for smaller emerging companies. This is purely speculation, but a listing on the TSX or a US listing would help with investor outreach and bring more people to the name.

And the best and last catalyst is simply earnings growth. If Westaim executes, you don’t need to rely on any hard catalysts, just enjoy the 20% IRRs.

Summary

Overall, I think Westaim is one of the more compelling opportunities available right now. The valuation caps downside, its recession/inflation resilient, has secular tailwinds from an aging population, and you’ve got a high quality management team at the helm. I would view this more as a core long rather than a quick trade - I think they can compound for quite sometime. And honestly, given the current political/macro environment, I’m a bit scared of anything that has too much consumer/market risk, and I’m happy to hide out with an integrated insurer + asset manager instead.

Please let me know if you have any questions or would like to give pushback on anything I wrote. You can send me a message on X @colhounlogan.